Chris Waller's Cuts, Declining Jobs, and the Quiet Case for Fed Independence

Why Fed independence matters for communications when the economy slows.

Next Wednesday, July 30th, is shaping up to be a wild day. The Federal Reserve’s Federal Open Market Committee (FOMC) will vote on whether to lower interest rates at a time of intensifying pressure from the White House. Most analysts currently anticipate the Fed holding rates steady with one or two dissents. What’s especially interesting is that second-quarter GDP numbers are scheduled for release that very morning at 8:30 a.m., and voting members of the FOMC won't see them until the rest of us do.

If real GDP matches or exceeds the 2.4% rate currently projected by the Atlanta Fed’s GDPNow model, we can expect the White House and conservative media to ramp up their pressure on Chair Powell, arguing that a strong economy warrants a rate cut. (This is, of course, the exact opposite of conventional economic logic.) Conversely, a lower-than-expected GDP print would prompt many economists to worry about potential economic weakness and advocate accelerating rate cuts at the July meeting.1

All of this makes preregistering the dovish case for a cut next week especially urgent. Luckily, Federal Reserve Governor Chris Waller did that in his recent speech The Case for Cutting Now. It opens: “My purpose this evening is to explain why I believe that the Federal Open Market Committee (FOMC) should reduce our policy rate by 25 basis points at our next meeting.”

Some critics dismissed Waller's speech as mere positioning for the Fed Chair job.2 I disagree. It’s a clear, specific, and well-articulated argument. One particular section merits attention in light of the White House seeking greater control over monetary policy (emphasis mine):

With the data in hand, estimates suggest that real GDP increased at an annual rate of about 1 percent in the first half of this year, compared with 2.8 percent in the second half of 2024. That comparison is important not only for the extent of the slowdown, which is considerable, but also because it is well below most estimates of the potential growth rate of the economy. […] The slowdown in GDP is evident in consumer spending. […]

Looking across the soft and hard data, I get a picture of a labor market on the edge.

Waller argues that inflation expectations are steady and that inflation, properly measured, is near target.3 Yet his most compelling point is the suggestion that the economy is slowing more sharply than the general consensus believes. Notably, as the White House pushes for greater control over monetary policy, this is precisely the argument they won't make.

The Republican Case for a Rate Cut

I’m not exaggerating. Aaron Rupar captured a funny moment on CNBC where House Speaker Mike Johnson argued “we should reduce interest rates, the American economy is hot.” The CNBC hosts had the awkward task of explaining that “if it’s too hot you don’t want to cut rates […] normally you think of a rip-roaring economy as not a good time to cut rates.” The hosts are right.

Or consider this case from CEA Chair Stephen Miran, who argued in my mentions yesterday that rates can come down because “The supply side economic policies of President Trump will bring inflation materially lower” and Trump’s policies “that expand the supply side of the economy by aggressive deregulation, providing tax incentives for increased labor supply and capital stock, and achieving energy abundance, are enormously disinflationary.”

This is not economic analysis but political messaging. These individual policies may be good or bad but their effect on overall nominal spending growth is uncertain. The most immediate thing Trump has done that we can see in the data is increase tariffs and decrease immigration, both of which reduce supply in the short-term and justify the Fed holding steady.

And it’s fine that it’s political messaging! As long as there is a space for actual analysis necessary to set monetary policy.

The Labor Market Now Versus 2024

Because there is a genuine debate here. How would you characterize the labor market of the first six months of Trump’s second term? Let’s compare it to the last six months of the labor market in 2024.

The unemployment rate remains about the same, but job growth has slowed noticeably. A central debate today is whether this slowdown reflects reduced immigration (which moderates job growth to maintain a steady unemployment rate) or signals actual economic weakening that the unemployment rate is missing or masking. The answer remains unclear.

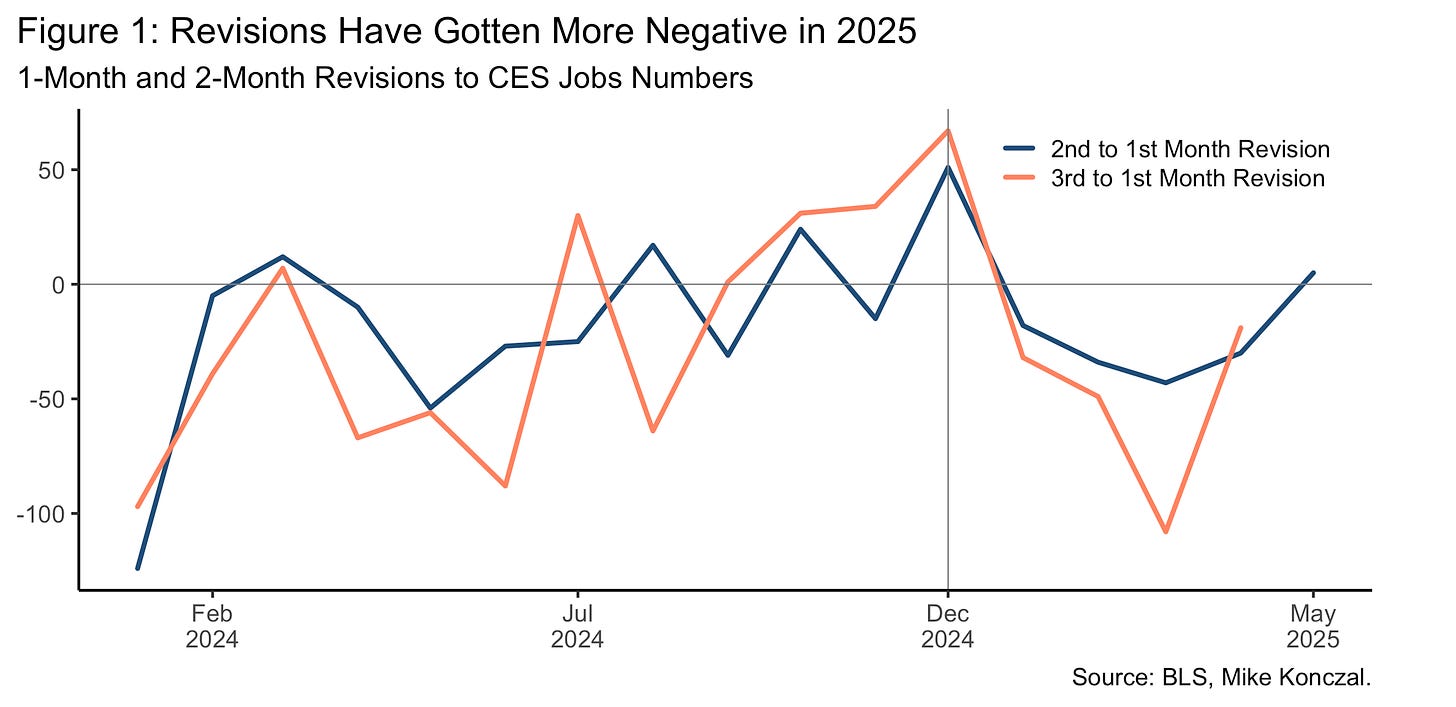

Additionally, as Figure 1 above illustrates, nonfarm payroll employment revisions have become more negative, with the three-month average shifting from +16 in the second half of 2024 to -52 for 2025 so far.

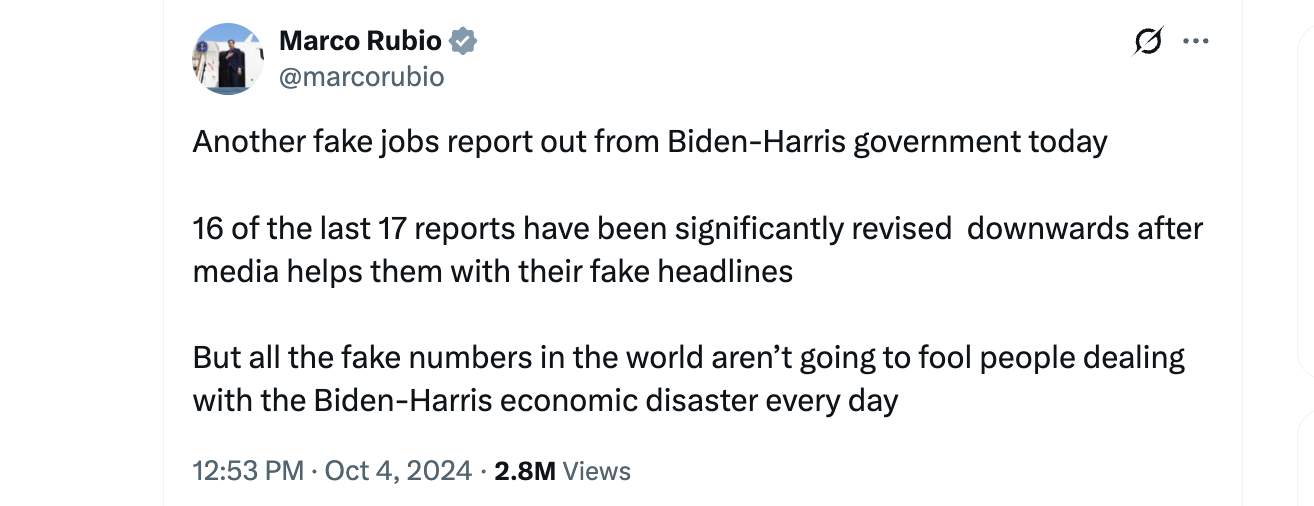

I bring that up because negative revisions were a major Republican talking point against the 2024 labor market. Here’s then Senator Marco Rubio tweeting that the BLS was cooking the books for the Biden administration through subsequent negative revisions (an example of contemporary coverage of this from Courtenay Brown at Axios).

Negative revisions naturally occur at the end of recoveries and during economic turning points due to the complexities of estimating business births, deaths, and seasonal adjustments. The current uptick in negative revisions is concerning. The Trump White House is not going to make that case. But independent members of the FOMC can and do.

Yet More on Fed Independence

This highlights an understated benefit of Federal Reserve independence. No administration, and especially not the Trump administration, is eager to announce, "We need to cut rates because the labor market is weakening on our watch." Politically, that's a tough headline. Independent Fed officials, however, can cite labor market weakness to justify rate cuts in ways that communicate clearly to financial markets without political baggage.

It isn’t the most dramatic rationale for central bank independence; you can read former Chairs Yellen and Bernanke on that. But it is a feature. Losing transparency about what truly informs policy decisions is another potential cost of increased White House influence over Fed policy.

And on the very unlikely chance real GDP is also negative, you are going to see how fast ChatGPT can make “Trump’s Recession!” press releases for everyone with a mailing list based on two subsequent quarters of negative GDP growth.

The case for Waller as Fed Chair is going to be awkward because he’s the best at being a Fed Governor, but Trump might want someone who will torch the place for him. It’s a no-win scenario, and when dealing with a Kobayashi Maru, you need to change the rules of the game.

Here’s a suggestion: Waller uses FACTS and LOGIC to DESTROY Democratic economists. Specifically, Waller crushed all the leading Democratic economists who debated him on the question of the slope of the Beveridge Curve in 2022. It’s some of Trump’s opponents too, be it a former President of Harvard who said the OBBB made him ashamed for the country, or a European globalist who ran the IMF. That’s a pitch that might help Waller, and I even tried to get a Ben Garrison MAGA political cartoon from AI for it:

Waller: “Standard central banking practice is to "look through" such price-level effects as long as inflation expectations are anchored, which they are. […] I consider survey-based measures of inflation expectations unreliable, and the market-based measures that I watch have remained firmly anchored.”

Since he spoke we have further evidence from the Michigan survey showing a thankful slowdown. Though picking up in recent weeks, market estimates of inflation rates haven’t really risen. The caveat I’d add to this, beyond the threat of political pressures raising expectations, is that once it’s in the market estimates it may become much harder to lower. I’m not sold on the inflation point (e.g. FRED) but that’s a debate for another day.